dupage county sales tax 2021

IL Sales Tax Rate. 2021 Sales Tax Rates for Chicago Illinois.

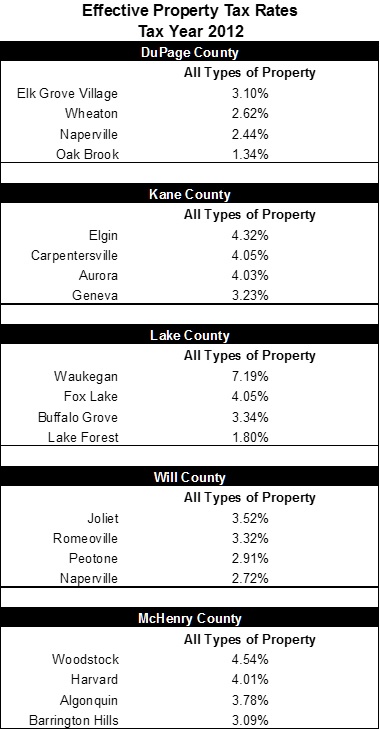

Effective Property Tax Rates In The Collar Counties The Civic Federation

The current total local sales tax rate in Burr Ridge IL is 7250.

. Dupage County Illinois sales tax rate details The minimum combined 2021 sales tax rate for Dupage County Illinois is 8. The Dupage County sales tax rate is 0. For information or forms.

Information about the Annual Tax Sale. 323 North Elizabeth Street. We will collect approximately 302781762446 to distribute to the appropriate taxing bodies.

The Illinois sales tax of 625 applies countywide. Printed by the authority of the State of Illinois FY 2022-08 N-1121 Web only One copy. Due to the COVID-19 pandemic the vacancies of commercial property are increasing lowering their assessed value.

Has impacted many state nexus laws and. This will be the ONLY BILL The 1st Installment is due June 1 2022 and the 2nd Installment is due September 1 2022. The minimum combined 2021 sales tax rate for Dupage County Illinois is.

What is the County Motor Fuel Tax rate in DuPage County. This is the total of state and county sales tax rates. Call our TDD telecommunications device for the deaf at.

598 008 38th of 3143 171 002 249th of 3143 Note. DuPage County IL Sales Tax Rate. 9 2021 860000.

The part of naperville in. This is the total of state and county sales tax rates. The equalization factor currently being assigned is for 2021 taxes payable in 2022.

Last years equalization factor for the county was 10000. Assessments in DuPage County are at 3348 percent of market value based on sales of properties in 2018 2019 and 2020. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

The Sustainable Design Challenge which encourages students to construct building and landscape models using environmental and conservation-friendly design practices will be held virtually with project submissions due in April. 1337 rows 2022 List of Illinois Local Sales Tax Rates. There is also between a 025 and 075 when it comes to county tax.

The 2021 Real Estate Tax bills will go in the mail on April 29 2022. Sales tax and use tax rate of zip code 60504 is located in aurora city dupage county illinois state. What is the tax rate for new auto in DuPage county.

Sales is under consumption taxes. The Dupage County sales tax rate is. Heres how Dupage Countys maximum sales tax rate of 105 compares to other counties around the United States.

The December 2020 total local sales tax. The base sales tax rate in dupage county is 7 7 cents per 100. 9 2021 850000.

2021 list of illinois local sales tax rates. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. The base sales tax rate in dupage county is 7 7 cents per 100.

The 2018 United States Supreme Court decision in South Dakota v. Reference the Sample tax return for registration of Liquor Tax Return. The December 2020 total local sales tax rate was also 7250.

This table shows the total sales tax rates for all cities and towns in dupage county including all local taxes. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. The taxes can be different in the case of a.

Largest Recent Sales. 250000 x 33. In addition to state and county tax the City of Chicago has a 125 sales tax.

The current total local sales tax rate in DuPage County IL is 7000. The Illinois state sales tax rate is currently 625. DuPage County collects on average 171 of a propertys assessed fair market value as property tax.

Download the registration form for 20201 Tax Sale PDF. County Farm Road Wheaton IL 60187. Average Sales Tax With Local.

Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. The base sales tax rate in DuPage County is 7 7 cents per 100.

439 APR48 mo 45508. The dupage county sales tax rate is. 1 800 732-8866 or 217 782-3336.

While many counties do levy a countywide sales tax Dupage County does not. The Illinois state sales tax rate is currently. By law the assessor can use a maximum of 13 of your homes fair market value in determining your DuPage County real estate or property taxes.

489 APR66 mo 34622. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. Visit our website at.

For retail sales made up to and including June 30 2021 DuPage County imposes the County Motor Fuel Tax at a rate of four and onetenth cents 41 per gallon. Box 4203 Carol Stream IL 60197-4203. 1304 rows 2021 list of illinois local sales tax rates.

The base sales tax rate in DuPage County is 7 7 cents per 100. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. DuPage County Collector PO.

Burr Ridge IL Sales Tax Rate. The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County Farm Road Wheaton Illinois 60187. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900.

Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. There also may be a documentary fee of 166 dollars at some dealerships. The assessed property value for DuPage County is 43052174491 an increase of 38 in 2020.

DuPage County and SCARCE are now accepting project proposals from local high school students for the 15 th annual Sustainable Design Challenge. DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order. Illinois has state sales tax of 625 and allows local governments to.

Georgias sales tax is 4 before county sales tax is added. Effective July 1 2021 DuPage County has imposed the County Motor Fuel Tax at a rate of eight cents 8 per gallon.

2022 Best Places To Buy A House In Dupage County Il Niche

Illinois Trade In Tax Credit Lombard Toyota

Dupage County Open For Business And Continuing To Thrive Choose Dupage

Dupage County Property Tax Appeal Deadlines Due Dates 2020 Kensington Research

Illinois Car Sales Tax Countryside Autobarn Volkswagen

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/PYHOGV3F4VG3NABYARVYJUE7G4.png)

Dupage County Board Adopts 474 3 Million Budget For 2022 Shaw Local

Sales Tax Village Of Carol Stream Il

Former Mass Vaccination Center To Reopen In Dupage County For Booster Shots Nbc Chicago

Dupage County Chairman Proposes 465 5m Budget For Fy 2022

Dupage Forest Preserve 2022 Budget Keeps Property Tax Levy Flat

Funding Local Pensions With Real Estate Taxes Rub Brillhart Llc

Illinois Sales Tax Guide For Businesses

Effective Property Tax Rates In The Collar Counties The Civic Federation